Facebook has become a powerful business tool. If you are using this platform in this way, you are probably wondering what is the relationship between Facebook sales and taxes, and what income limits apply. You can find an explanation in our article.

Legality of sales - the key to success

Is it legal to sell on Facebook? Yes, but you must follow certain rules and guidelines. The sale of certain products may be prohibited. That's why it's always a good idea to check local laws and Facebook rules.

Facebook sales and tax

Today, more and more people are using social media as a sales platform. Facebook, with its billions of users, has become one of the main destinations for sellers and entrepreneurs. So how do you start selling on Facebook while keeping the tax aspects in mind? Here are some steps to help you understand the topic.

Understanding the basics of selling on Facebook

Before selling, it is important to understand what tax obligations you may have. Selling on Facebook and taxes is a complex topic, but knowing this will protect you from potential problems.

Individual Sales and Business

If you plan to occasionally sell things you don't need, you probably don't need to worry about taxes.That's why if you're thinking of selling on a regular basis, it's worth considering starting a business and understanding the associated tax obligations.

Make sure your entries are correct

Whether you're a registered trader or not, always keep accurate records of all transactions. This will be very important in case of a tax audit or if you decide to expand your business.

Learn the rules for selling on Facebook

Facebook has its own guidelines for selling on the platform. Read them to avoid potential problems and know what products you can sell.

When do you pay sales tax on Facebook sales?

In Poland, the issue of Facebook sales and the taxation of these sales depends on the type and scale of your business. Here are some important details about paying tax on sales made through Facebook:

- occasional sales - if you occasionally sell items, for example, used items that you no longer need, such sales are considered private. Then the income from such sales is not taxed, as a rule. Theoretically, you have to pay tax on occasional sales in two cases: when the seller earns money on the product sold, that is, he sells it at a higher price than the one for which he bought it, and when he sells a product he bought less than 6 months ago ;

- regular sales - if you regularly sell on Facebook and earn money from it, it can be considered running a business. In this case, it is necessary to register your business and pay the taxes due (PIT or CIT);

- inspections - although the risk of inspection in the case of small, private sales is small, the tax office has the right to check the source of your income. That's why it's a good idea to keep accurate records of your transactions, especially if you're an active seller.

Under what amount can you sell tax-free?

Many people wonder if there are certain sales limits below which they don't have to pay tax. In Poland, as of July 2023, this amount is 75% of the monthly minimum wage, or PLN 2,700 per month.

How to avoid problems at the tax office?

Does the tax regulate sales on Facebook? Of course! That's why it's important that you keep accurate records of all your transactions and regularly check whether you've exceeded the set limits. This will help you avoid unpleasant surprises. If the income from sales on Facebook flows into your bank account, this can prove to the Tax Office that you are running a business. When sales become regular, consider officially registering your business and paying taxes.

Effective selling on Facebook - practical tips

- Understand your customer - know your customer. Knowing who your target audience is will help you better tailor your offer;

- professional photos - in the world of e-commerce, good quality photos play an important role. Use professional photography to show your products in the best light;

- proactivity and communication skills - respond to comments, nurture relationships with customers. This will help you build trust and loyalty among your customers;

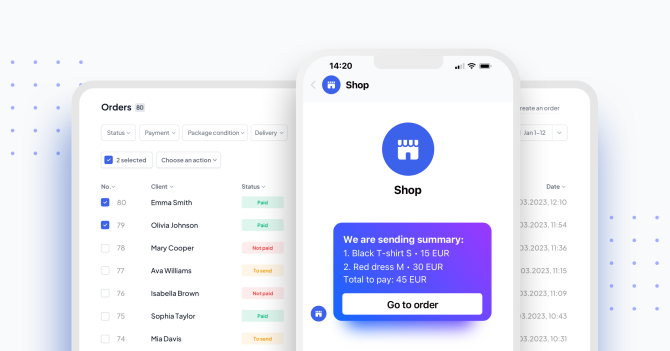

- use advanced tools - use tools such as Selmo's Facebook Live Streaming Program to improve the quality and effectiveness of the products you sell.

Tax issues and selling through social media

Selling on Facebook and taxes is a topic that may seem complicated, but with the right knowledge and tools, you can sell effectively and enjoy earnings. Remember that the key to success is to understand your customer, offer quality products and comply with regulations. This will help you avoid problems with the tax authorities and enjoy the profits from your business.